Hsmb Advisory Llc for Dummies

Table of ContentsA Biased View of Hsmb Advisory LlcSome Known Factual Statements About Hsmb Advisory Llc The Single Strategy To Use For Hsmb Advisory LlcThe 3-Minute Rule for Hsmb Advisory Llc10 Simple Techniques For Hsmb Advisory LlcHsmb Advisory Llc - Questions

Ford says to steer clear of "money value or permanent" life insurance policy, which is more of a financial investment than an insurance coverage. "Those are extremely complicated, included high compensations, and 9 out of 10 individuals do not need them. They're oversold because insurance policy representatives make the biggest compensations on these," he states.

Impairment insurance policy can be expensive. And for those that opt for long-lasting treatment insurance policy, this policy might make disability insurance coverage unneeded.

The Hsmb Advisory Llc PDFs

If you have a persistent health problem, this kind of insurance policy can end up being crucial (Insurance Advisors). Don't let it emphasize you or your financial institution account early in lifeit's generally best to take out a plan in your 50s or 60s with the anticipation that you won't be using it up until your 70s or later.

If you're a small-business proprietor, consider protecting your income by acquiring organization insurance. In the occasion of a disaster-related closure or duration of restoring, organization insurance can cover your income loss. Consider if a significant climate occasion affected your storefront or production facilityhow would certainly that influence your income?

And also, utilizing insurance can occasionally set you back more than it conserves in the lengthy run. If you get a chip in your windscreen, you may think about covering the repair service expense with your emergency cost savings instead of your car insurance coverage. Health Insurance St Petersburg, FL.

Things about Hsmb Advisory Llc

Share these pointers to protect enjoyed ones from being both underinsured and overinsuredand consult with a trusted expert when needed. (https://www.viki.com/collections/3896580l)

Insurance coverage that is bought by a specific for single-person protection or insurance coverage of a family. The individual pays the costs, as opposed to employer-based medical insurance where the company often pays a share of the costs. People might shop for and acquisition insurance coverage from any type of plans offered in the individual's geographical region.

Individuals and family members may qualify for monetary support to lower the price of insurance premiums and out-of-pocket costs, however just when enlisting with Link for Health Colorado. If you experience specific adjustments in your life,, you are eligible for a 60-day duration of time where you can register in a specific plan, also if it is outside of the annual open registration duration of Nov.

15.

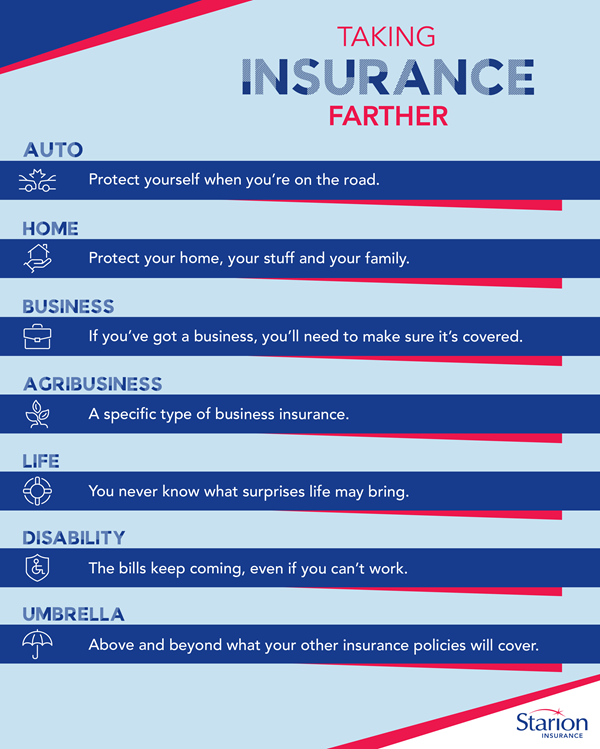

It might appear basic but recognizing insurance types can additionally be puzzling. Much of this complication comes from the insurance policy industry's continuous goal to design customized protection for insurance policy holders. In creating flexible policies, there are a range to choose fromand every one of those insurance policy kinds can make it challenging to recognize what a particular policy is and does.

An Unbiased View of Hsmb Advisory Llc

The very best area to start is to speak concerning the distinction in between both types of basic life insurance policy: term life insurance policy and irreversible life insurance policy. Term life insurance coverage is life insurance policy that is only active for a time period. If you die during this duration, the individual or individuals you've named as beneficiaries might obtain the cash payout of the policy.

Many term life insurance coverage policies allow you transform them to a whole life insurance coverage plan, so you do not shed insurance coverage. Typically, term life insurance policy costs payments (what you pay monthly or year right into your policy) are not secured at the time of purchase, so every five or ten years you own the plan, your costs can climb.

They also often tend to be cheaper total than entire life, unless you purchase a whole browse this site life insurance coverage policy when you're young. There are also a couple of variants on term life insurance policy. One, called team term life insurance, prevails amongst insurance policy choices you might have accessibility to via your employer.

The Facts About Hsmb Advisory Llc Uncovered

Another variant that you may have accessibility to with your employer is extra life insurance coverage., or funeral insuranceadditional insurance coverage that could aid your family members in instance something unanticipated occurs to you.

Irreversible life insurance merely describes any kind of life insurance policy plan that doesn't run out. There are a number of sorts of irreversible life insurancethe most common kinds being whole life insurance policy and universal life insurance policy. Entire life insurance is exactly what it appears like: life insurance coverage for your whole life that pays to your beneficiaries when you die.